Budget Information and Resources

- Organization Rollup Table

- Pending Updates - will be added soon.

- Account Rollup Table

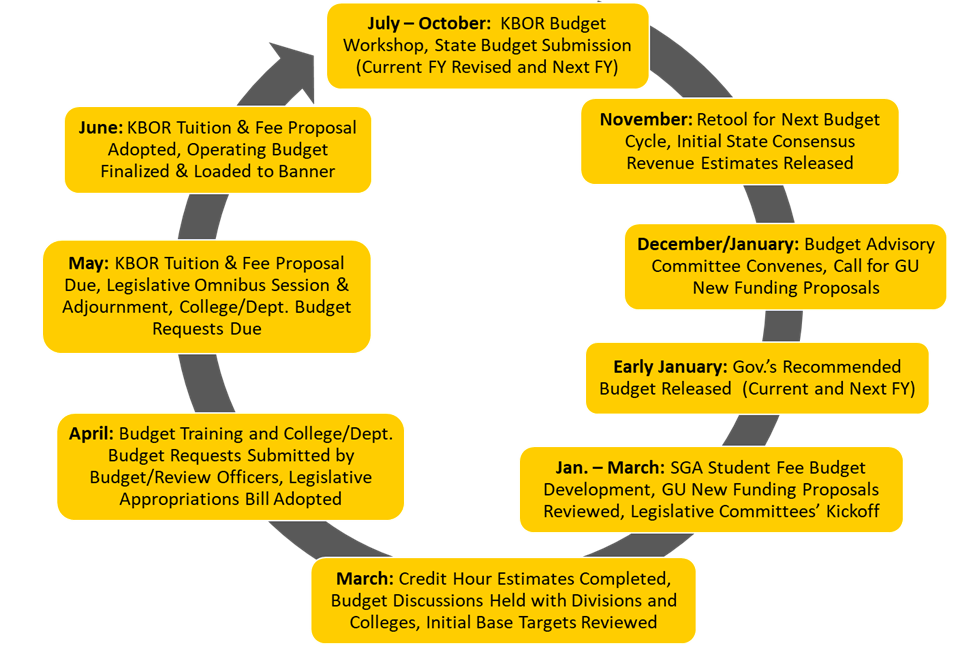

You can find the current schedule here.

You can find next year's FY27 payroll schedule here.

The structure of an expense or a revenue is often identified as a ‘FOAP’ or ‘FOAPAL’, this is in reference to the fund, organization, account, and program line that the expense or revenue is coming from or going to. A more detailed explanation of each portion of that identification can be found below.

Fund: The purpose of a fund is to identify the source of funding and segregate cash and other resources designated for specific purposes.

Organization: The purpose of an organization code is to identify a unit of budgetary responsibility. It is normally used to define "who" spends the money.

Account: The purpose of an account code is to identify the natural classifications or "what" the money is being spent on.

Program: The purpose of a program code is to identify the organization objective that is being accomplished or "why" the money is being spent.

An expense's Program Code helps to identify "why" money is being spent, it allows us to better track expenses associated with each objective that is being accomplished on campus. The following pages include the Wichita State University Program Code options, which are each aligned with State of Kansas Program Codes to allow us to accurately meet reporting requirements to the State. These descriptions are resources from and can be found on the NACUBO FARM site. Find the list of Programs here.

General Use Funds are derived from two separate funding sources: State General Fund and General Fees.

- State General Fund - appropriations made by the Governor and Legislature from State of Kansas tax revenues. Appropriations from the State General Fund may be used for general operating purposes or may be targeted for a specific use such as aviation research, payment of debt service, etc. General operating purposes may include both salaries and fringe benefits and other operating expenditures.

- General Fees - revenue from the collection of student tuition. The University can only spend actual tuition dollars collected. If tuition dollars collected fall short of the original estimate, budgets must be reduced accordingly.

Restricted Use Funds - represent revenues derived from all sources other than tax revenues and tuition. Restricted Use Funds are special revenues that must be used for the specific purpose collected.

University Support Staff Salaries - salaries of employees who are under the Kansas Civil Service Act. Base salary levels and annual increases are determined on a state-wide basis by the Kansas Department of Administration based on the outcome of the budget appropriation process.

Unclassified Salaries - salaries for faculty, unclassified professional staff, lecturers, and graduate assistants. Personnel in this category are under the auspices of the Kansas Board of Regents. Annual increases may be awarded on a merit basis resulting from the outcome of the budget appropriation process. Because of budget constraints, there may be years where merit increases are not awarded.

Fringe Benefits - expenditures for retirement contributions, health insurance, FICA, workers compensation, unemployment compensation, and leave upon retirement assessment that are paid by the University for each employee.

Student Salaries - salaries paid on an hourly basis to enrolled students who perform technical, clerical or custodial services to the campus.

Shrinkage - the amount of savings the University must generate from employee turnover or vacant positions. The shrinkage rate for Wichita State University is 2.28%.

Other Operating Expenditures - amounts budgeted for all University operating expenditures except salaries and fringe benefits. Major examples of OOE include equipment, copier rental, equipment rental, office supplies, laboratory supplies, library acquisitions, travel, telephone costs, printing, postage, etc.

You can find the current rates here.