IRS Federal Tax Return (Transcript)

Your FAFSA has been chosen to undergo federal verification and/or additional review due to conflicting information.

You and/or the contributor(s) listed on your FAFSA must provide the appropriate 1040 Federal Tax Return or Record of Account Transcript to confirm the accuracy of your financial aid information.

What you and/or your contributor(s) need to submit:

- 2023 signed IRS 1040 Tax Return and all associated schedules

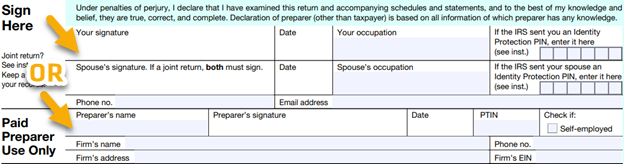

- A ‘signed tax return’ must include one of the following:

- A physical signature from at least one of the tax filers on the designated signature line - OR -

- The tax preparer’s stamped, typed, signed, or printed name and SSN, EIN, or PTIN.

- A ‘signed tax return’ must include one of the following:

- OR -

- 2023 Record of Account Transcript

- Go to IRS.gov and select "Get Your Tax Record" link in the Tools Section.

- Call the IRS at 1-800-908-9946.

- Locate your local IRS office at IRS.gov.

- You will need your social security number, date of birth, and the address on file with the IRS (normally this will be the address used when your IRS tax return was filed).

- 2024 signed IRS 1040 Tax Return and all associated schedules

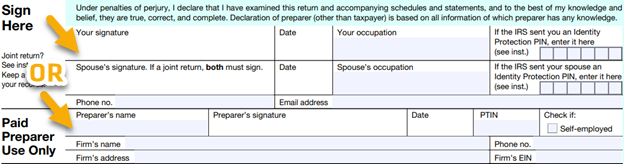

- A ‘signed tax return’ must include one of the following:

- A physical signature from at least one of the tax filers on the designated signature line - OR -

- The tax preparer’s stamped, typed, signed, or printed name and SSN, EIN, or PTIN.

- A ‘signed tax return’ must include one of the following:

- OR -

- 2024 Record of Account Transcript

- Go to IRS.gov and select "Get Your Tax Record" link in the Tools Section.

- Call the IRS at 1-800-908-9946.

- Locate your local IRS office at IRS.gov.

- You will need your social security number, date of birth, and the address on file with the IRS (normally this will be the address used when your IRS tax return was filed).

Financial Aid Pro Tip:

Review your Financial Aid Dashboard to confirm which contributor needs to submit the appropriate documentation.