Petty cash is a small amount of money kept in a department for incidental expenses. This case caught my attention because the fraudster allegedly embezzled more than $57,000 from petty cash over four years.

There's nothing trivial about $57,000. This post is a primer about petty cash and change funds so you can distinguish between them and know how they work at WSU.

Petty Cash Primer

Investopedia has an in-depth look at petty cash, detailing how it works and receives oversight. Key points include:

- It's for minor expenses or to reimburse employees for small out-of-pocket expenses made for the organization.

- A designated person, called a custodian, keeps the cash in a locked box or drawer.

- Another person verifies the balance on a regular schedule.

- Fund amounts from $50 to $200 are typical.

Petty Cash Problem

Tupelo Daily Journal - Former Northeast Community College employee charged with embezzlement

The reporter's description of the scheme (and its size) suggests that the fraudster may have used a cash change fund (money with a cashier) rather than a petty cash fund.

In either case, insufficient oversight was essential to her scheme:

"She is accused of embezzling cash from one of the college's petty cash fund and from students as they paid various college-related fees. Investigators determined more than $57,000 was stolen from the college.

"The alleged scheme went on from May 2016 until February 2020. Haynie was able to manipulate the records of how cash was collected and deposited. The lack of internal controls allowed her to hide the scheme for nearly four years."

The article doesn't describe the controls lacking, but it was likely regular reconciliations and independent verification. Even a quick reasonableness check could have highlighted something was wrong.

Cash Funds at WSU

The Accounts Receivable team in Financial Operations is responsible for overseeing the collection of all payments intended for WSU, whether electronically, through the mail, or in person.

Accounts Receivable has an Information for WSU Departments webpage that provides instructions for different cash handling and payment processing scenarios encountered by departments.

WSU does not use petty cash. Using pcards has minimized the need for WSU to issue checks for small dollar amounts or for employees to incur out-of-pocket expenses for WSU. A university department should never make an expense outlay from petty cash, a change fund, or undeposited cash from sales proceeds.

Should an employee incur an out-of-pocket expense for the university, Accounts Receivable provides two avenues for reimbursement:

- Cash Reimbursement Request (for amounts under $25)

- Invoice Control Document (the request must total $5.01 or more)

The Cash Reimbursement Request is more cost-effective because WSU does not need to issue a check, and turn-around time is immediate. An ICD is used to process reimbursement requests of $25 or more.

Cash reimbursements require budget officer approval and receipts showing what was purchased and explaining its business purpose.

Accounts Receivable authorizes and oversees all change funds used by WSU departments. Clinics, recreational facilities, and performance facilities are examples of operations with change funds.

Accounts Receivable:

- Authorizes change funds exclusively for making change.

- Requires departments to complete a monthly reconciliation of their change fund.

- May audit the fund without notice (as may state or WSU auditors).

- Requires departments to deposit all sales proceeds within one business day.

A department must not use a change fund, or sales proceeds, for check cashing, loans or advances, or payments for goods or services.

Departments and organizations can request a cash box for up to $150 from Accounts Receivable for special events. Accounts Receivable can also supply authorized card readers for accepting electronic payments.

Working with Accounts Receivable ensures the card readers comply with Payment Card Industry Data Security Standards (PCI DSS) and the university's Security of Payment Card Data Policy.

Addendum - Ali's Conundrum

Soon after I posted this entry, Ali Levine emailed me with her petty cash story. I met Ali years ago when she was the School

of Music's administrative officer before becoming a Certified Microsoft Trainer. Here's

a picture of Ali presenting me with a Microsoft Office Power User certificate.

Soon after I posted this entry, Ali Levine emailed me with her petty cash story. I met Ali years ago when she was the School

of Music's administrative officer before becoming a Certified Microsoft Trainer. Here's

a picture of Ali presenting me with a Microsoft Office Power User certificate.

If you've met or worked with Ali, you know her conscientiousness. She has a relatable, humorous story for anyone trying to do the right thing, contrasting with the situation above.

Ali's tale of a young receptionist's conundrum:

This case reminds me of a previous job where we had to handle cash. We kept petty cash (maybe $10 total) for balancing the register at the end of the day, maybe a few pennies here and there, rarely more than $1.

One day, a lady paid cash for something like a $5 item, handed me $20, and said, "keep the change…."

She left, and I thought, I can't just throw a $20 bill in here and have us be off by $15 at the end of the day, so I made an envelope called "keep the change" to put in our petty cash bin.

In addition to being unable to account for this extra $15, this business was a veterinary clinic, so we also had to track taxable versus nontaxable items. Nobody knew whether "keep the change" was taxable, so nobody wanted to do anything with it!

So that $15 stayed in that envelope for eons. We finally made a code in our software called "keep the change" and put it as a charge on the lady's account to deposit the funds, but that was probably months later.

In the end, it was a little silly. The lady thought she was doing something nice, but I wished she would have just taken her change!

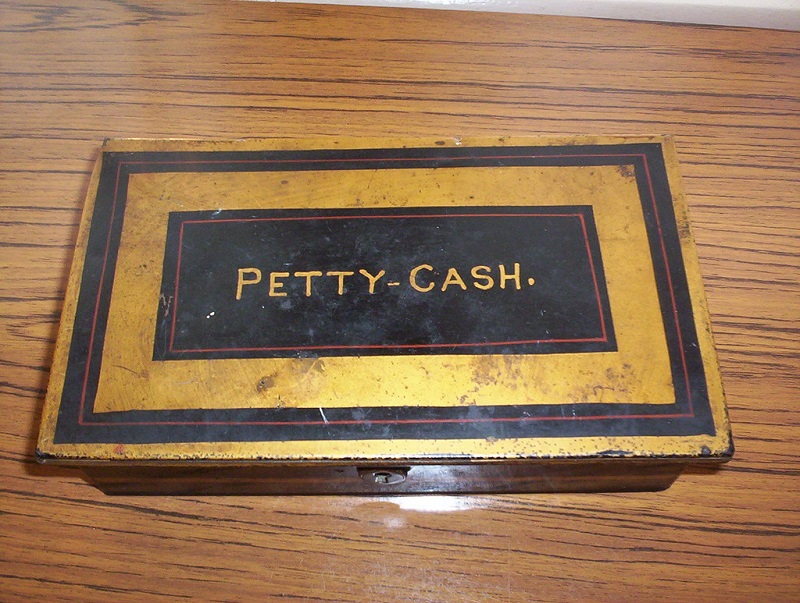

Image attribution: Petty Cash tin from yesteryear by friskierisky is licensed under CC BY-NC 2.0